(Approved for testing under SECP Regulatory Sandbox Guidelines 2019)

About Alternative Assets

Alternative Assets Mutual Funds are a type of mutual funds that invest in non-traditional asset classes, going beyond the usual equities and bonds. These funds aims to provide diversification, hedge against inflation and manage risk by incorporating alternative investments in their portfolios.

Introduction to HBL Livestock Fund

The HBL Livestock Fund is crafted to give investors exposure to the livestock industry, targeting cattle fattening and related farm activities. The fund aims to leverage the growth and profitability of the livestock sector while offering diversification benefits to its investors.

Click here to access the Fund’s Offering Document

Salient Features

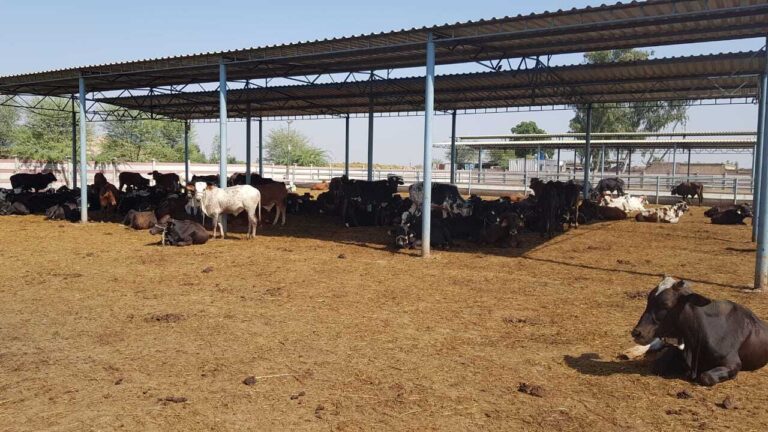

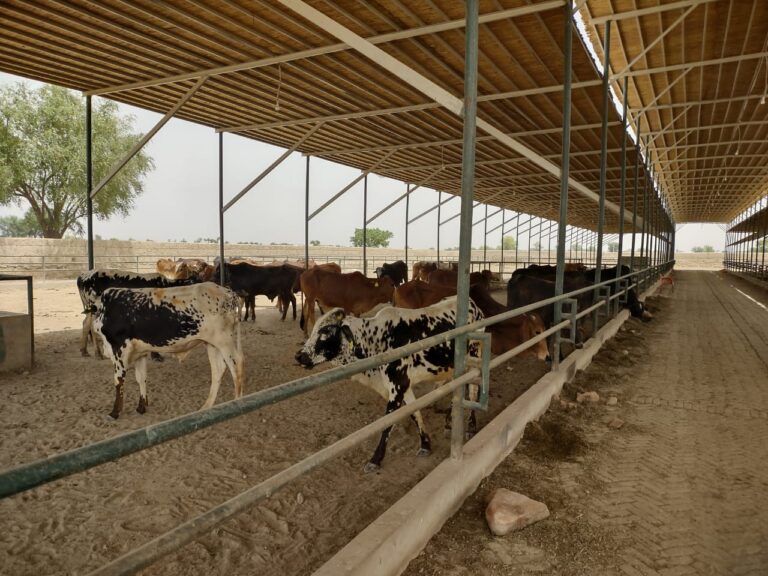

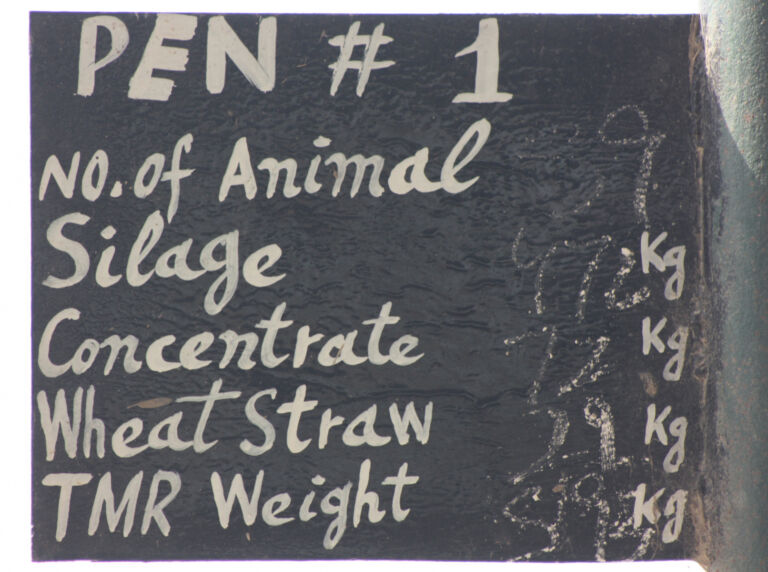

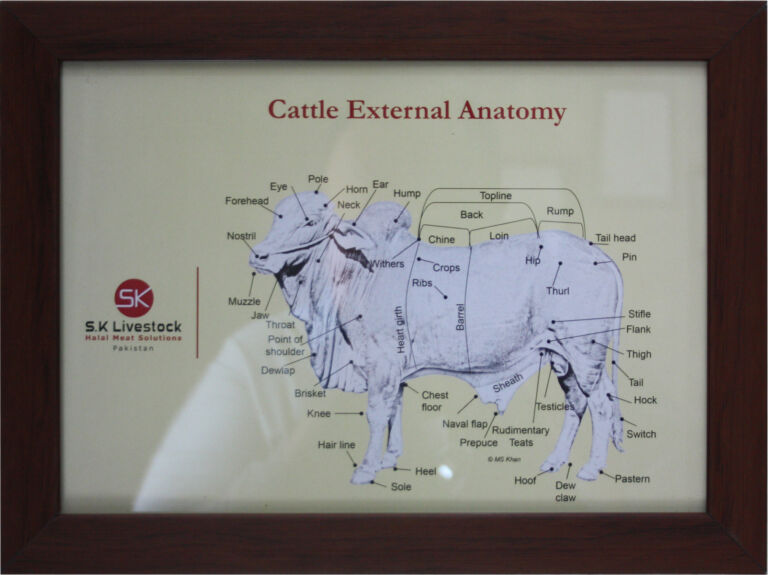

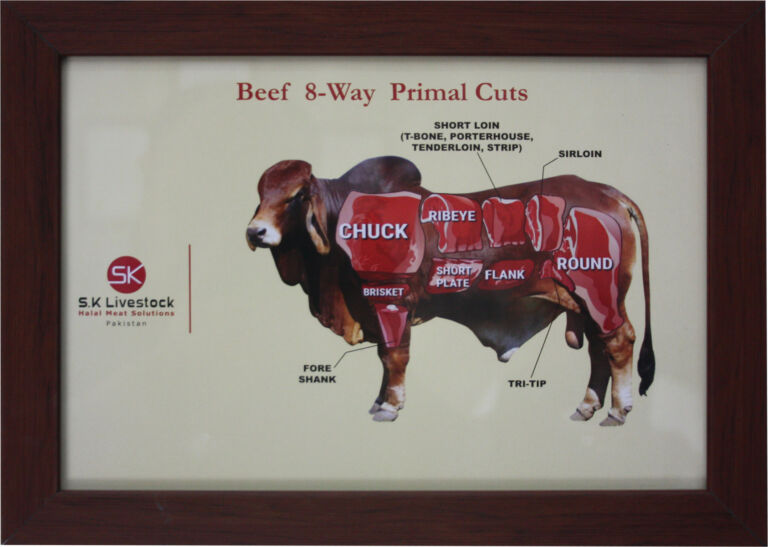

Sector Focus: The fund primarily invests in cattle fattening and produces meat for businesses involved in meat export.

Risk Mitigation: All assets of the Fund are takaful covered, ensuring comprehensive protection in line with shariah principles.

Inflation Hedge: Funds like commodities and real assets often serve as a hedge against inflation, potentially preserving purchasing power.

Social Impact

Economic Development: This fund may lead to job creation opportunities in cattle farming and related industries. This can boost local economies, especially in rural areas.

Supply Chain Stability: The fund may provide a steady supply of meat to both local and export industry, contributing to food security and availability. It can also enhance the quality and safety of animal-based food products, benefiting public health.

Infrastructure Improvement: Bringing the livestock sector within a regulated regime of Mutual Funds may also improve the efficiency of the cattle fattening farms and also upgrading the local practices to an established livestock farms management skills.

Innovation and Sustainability: This Fund may encourage and support the adoption of sustainable and livestock farming practices, which can reduce environmental impact and improve animal welfare.

Awards and Recognition

Performance at a Glance

Initial Testing Period

(April 14, 2023 till February 14, 2024)

- Duration: Ten (10) months from the strike date.

- Allowed Net Assets: PKR 100 Million

- PAR Value: PKR 1,000 per Certificate

- NAV Frequency: At every sixty (60) days

- Farms Engaged: One (1)

- Herds Cycle: Two

- Herd Size: Approx 625 Animals

- Benchmark: Trailing 12 Months Average CPI

- Fund Preservation: Herd fully takaful covered

- Returns Generated: 29.50% (Annualized Return)

Second Testing Period

- Duration: Up to six (6) months till Dec 31, 2024 from the strike date or till the time the regulatory framework is in place, whichever is earlier

- Allowed Net Assets: PKR 1.5 Billion

- PAR Value: PKR 1,000 per Certificate

- NAV Frequency: Every fifteen (15) days after initial 38 days.

- Farms Engaged: Ten (10)

- Herds Cycle: Multiple

- Herd Size: Approx. 13,000 Animals

- Benchmark: Trailing 12 Months Average CPI

- Fund Preservation: Herd Fully takaful covered

Recent Updates

| NAV Cycle | NAV Date | Net Asset Value | Herd Size | Farms Engaged |

| Base NAV | 23-Jul-24 | 1000.00 | – | 10 |

| First NAV | 30-Aug-24 | 1026.43 | 5,166 | 10 |

| Second NAV | 16-Sep-24 | 1022.16 | 6,770 | 10 |

| Third NAV | 30-Sep-24 | 1,042.69 | 8,004 | 10 |

| Fourth NAV | 15-Oct-24 | 1,028.70 | 9,093 | 10 |

| Fifth NAV | 31-Oct-24 | 1,025.57 | 9,855 | 10 |

| Sixth NAV | 15-Nov-24 | 1,015.62 | 9,810 | 10 |

| Seventh NAV | 29-Nov-24 | 1,061.07 | 9,376 | 10 |

| Eighth NAV | 16-Dec-24 | 1,077.65 | 9,468 | 10 |

| Ninth NAV | 31-Dec-24 | 1,081.20 | 8,066 | 10 |

| Tenth NAV | 28-Mar-25 | 1,094.6400 | 9,158 | 10 |

| Eleventh NAV | 30-Apr-25 | 1,086.1415 | 8,656 | 9 |

| Twelfth NAV | 30-May-25 | 1,038.5082 | 0 | 9 |